The recent surge in healthcare fraud has prompted heightened enforcement of the Anti-Kickback Statute (AKS). Government agencies are cracking down on illegal financial arrangements that jeopardize patient care. This article explores the significance of AKS enforcement, the impact on healthcare providers, and strategies for compliance in an evolving regulatory landscape.

Continue readingEstablishing a Strong Compliance Culture in Behavioral Healthcare: Part 2

Use Education and Influencer Skills to Create Value

The stigma and complexities in behavioral health present compliance challenges that other healthcare organizations may not face. In this two-part series, I’m exploring how these challenges drive the need to minimize risk for behavioral health organizations through standardizations and building predictable processes.

Read Part I, “Establishing a Strong Compliance Culture in Behavioral Healthcare: Minimize Risk and Add Value Through Standardization and Metrics”

In Part I, I examined why establishing a strong culture is critical for behavioral health organizations to minimize risk. I highlighted how using the Office of the Inspector General (OIG) ‘s seven elements and making the most of metrics can help behavioral health organizations build culture and show how Compliance adds value.

Below are two more fundamental activities for creating a positive culture: being an effective influencer and emphasizing education. Prioritizing these activities – along with using the OIG’s seven elements and making the most of metrics – will enable you to build a culture that helps behavioral health organizations minimize risk.

Behavioral health’s complexities

Behavioral health is unique in that we have the stigma that goes along with our work. The population we serve has mental health and addiction issues, plus co-occurring medical, legal, educational, work, and family issues.

In addition to the lack of understanding around mental health and addiction, a big challenge in behavioral health is that we don’t have clarity yet on the differences between compliance, quality, risk, and safety. We’re still trying to define the differences and the commonalities and where they overlap.

We also face a lack of consistency in behavioral health. We’ve come a long way in my 35 years, with more evidence-based practices and more research-based approaches. But we lack a common approach to measuring outcomes and what works as well as consistency from state licensing and accrediting bodies.

Two more culture-building tips

In Part I, I explored how to successfully begin creating a healthy culture by using the OIG’s seven elements and making the most of metrics. Two more activities – being an effective influencer and emphasizing education – are key to navigating behavioral health’s complexities and building a culture that minimizes risk through standardizations and predictable processes.

1. Be an effective influencer

Building solid relationships and being visible throughout the organization are crucial to building a strong culture of compliance. And acting with empathy helps you encourage others to proactively work with you to add standardizations and build in predictable processes.

This comes from my belief that people want to be compliant. They want to do the right thing. Assume that employees are doing their best with what they have, and lead with that.

If there’s an issue, it’s often because employees have not been given the right information, resources, or skills. Our job in compliance is to give employees the right information, resources, skills, and support they need – not to assume that they’re bad or lazy.

Leading with empathy

At my old organization, we practiced lean management, and one of my favorite sayings was, “Hard on the process, easy on the people.”

Being empathetic is more effective than blaming and pointing fingers. If I have a noncompliance issue, I approach it with employees as, “It’s my fault. Compliance failed you by not giving you a good enough policy, procedure, or training.”

When I take this approach, you can feel the energy in the room shift. It transitions from a negative and fearful moment to a foundation of empathy and a healthy culture for compliance.

It’s also helpful to have an open-door policy. If you’re new to an organization, have lots of conversations to assess what your colleagues’ previous experience was with Compliance. You have to be willing to hear things that are tough to hear and be responsive to that.

“Hard on the process, easy on the people.”

It’s key to building trust and being able to shape culture as an influencer. And it’s important to follow through on integrating their feedback into your compliance program.

I like to tell new colleagues, “Here are the things I’ve heard that didn’t work, and this is what we want to do differently.”

The change management process is a continual effort to build and make it better, and it takes time to get everyone’s buy-in. Resistance is absolutely normal and expected.

To overcome resistance, communicate the why behind what you’re doing. Communicating and doing a lot of listening builds trust.

If you’re changing policies or processes, explain why you have a better way to do it. Emphasize the importance of following the seven elements and integrating them into daily workflows.

Be confident that you have the knowledge, skills, and abilities to address the compliance issues the organization is facing. Be confident to push back, to question, and to challenge.

As compliance officers, we bring a specialization that is rare. Don’t be afraid to be a person of influence.

Being visible

It’s helpful to embed yourself into each operational area. Be part of each area’s initial orientation with staff, go to trainings, do mock surveys, and attend team meetings.

When you’re embedded, you’ll start hearing about issues to look into. Then you can follow up with teams and say, “I wonder about this. Do you have any concerns in this area?”

The more visible you are, the more that colleagues see you and trust you as a partner. They’ll appreciate what you bring, and in turn, they’re more likely to bring issues to you. This can help you catch a potential problem early to prevent it from becoming a bigger issue.

2. Emphasize education

Education is closely related to using influence, and ongoing training is key to helping the organization minimize risks through standardizations and building in predictable processes.

In an earlier role, I joined an organization where policies had not been updated in about 10 years. There were missing policies as well as conflicting and duplicative policies.

I worked with each department – from nursing to medical directors to human resources – to review their policies and make sure they were aligned with their actual practices. This allowed each operational area to contribute to their policies and to secure any funding and training needed to resolve the discrepancy issues.

Building cohesive policies across the organization was an opportunity for education around regulations and why they were in place. It also helped get employees’ buy-in and positioned them to champion compliance. They’re putting the policies to work every day and now they understand why.

Monthly check-ins are also valuable for ongoing education and training. I do monthly phone calls with all our medical leads and nursing leads. It’s an opportunity for sharing and cross-training across different levels of care, or different settings; everyone can learn best practices from one another.

Sometimes training becomes a check-the-box exercise. But effective training – testing for competence and making sure employees understand how to apply it in their daily work – is crucial.

In behavioral health, we conduct trainings around critical care areas such as diagnosing substance and suicide prevention. We have to ensure that our training is updated and affecting care.

Educate yourself on compliance industry resources

As you build a compliance culture, it’s helpful to get involved with the HCCA (Health Care Compliance Association).

Using HCCA resources and asking for help from the compliance community – not normally people who we interact with in behavioral health – keeps you from having to start from scratch. Leverage existing programs and talk with people who are already doing the work.

Also, using a tool like YouCompli gives you some of the structure you need for procedure development – the forms, trainings, whatever it might be. It will save you so much time and resources.

Benefits of a healthy compliance culture

The stigma and the complexities we deal with in behavioral health present extra compliance challenges. Yet there are ways to effectively tackle these challenges to help behavioral health organizations minimize risk and show how Compliance adds value.

Establishing a positive culture in behavioral health and showing how Compliance adds value includes four activities:

- Using the OIG’s seven elements

- Making the most of metrics

- Being an effective influencer

- Emphasizing education

Prioritizing these areas will help give you the knowledge, resources, and confidence to address the organization’s compliance challenges. Compliance officers bring a specialization that is rare. Don’t be afraid to be a person of influence to build the culture you know will add value for your organization.

Read Part I, “Establishing a Strong Compliance Culture in Behavioral Healthcare: Minimize Risk and Add Value Through Standardization and Metrics”

Maeve O’Neill, MEd, LPC-S, CHC, CDTLF, National Compliance Director for Circa Behavioral Healthcare Solutions, has worked in behavioral health for 35 years. Maeve has a passion for quality and safe care as well as happy and healthy staff. A former behavioral health surveyor with The Joint Commission, she is committed to excellence.

How YouCompli helps

At YouCompli, we believe compliance professionals create value in healthcare organizations through standardization and metrics. That’s why we supply tools for our customers that they can be confident in using to educate and influence their stakeholders. YouCompli subscribers receive regulatory tools including primary research and regulatory alerts, practical analysis and impact, decision criteria and affected departments, business requirements, and model procedures. Every regulatory tool is validated by Horty Springer LLP, the nation’s top law firm.

Download best practices for creating a strong compliance culture and measuring its impact now

Never miss an article on establishing a strong compliance culture in healthcare!

Register for emails from YouCompli.

Establishing a Strong Compliance Culture in Behavioral Healthcare: Part 1

Stigma and complexities of behavioral health create the need to minimize compliance risk through predictable processes, metrics, and the OIG’s 7 elements.

Continue reading10 Tips for Building a Compliance Culture in Healthcare

The tips below explore how you can convince leaders that a strong compliance culture adds value to the organization. These best practices can help you establish a healthy compliance culture with effective training and measurement and, in turn, enable your organization to better manage and control risk.

Continue readingPost-PHE Preparations: Ensuring Quality Patient Care

How to use the OIG’s seven elements and HHS roadmap to guide Compliance and Operations – helping healthcare organizations ensure quality patient care post-PHE.

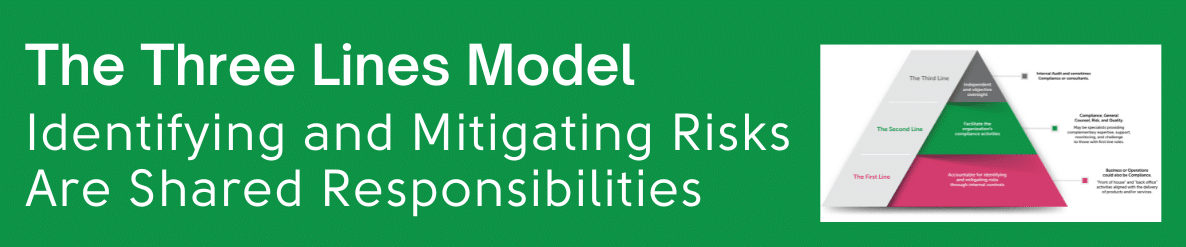

Continue readingHow the Three Lines Model Strengthens Healthcare Compliance

Show that healthcare compliance and operations share responsibility for identifying and mitigating risks with the Three lines Model – a strategic partnership.

Continue readingTransforming Compliance to a Department of Yes

Five impactful, interrelated, and critical actions transform Compliance from the “Department of No” to the “Department of Yes,” creating strategic value.

Continue readingPatient-Focused Elements of an Effective Healthcare Compliance Program

Improve patient experience. Use the OIG’s seven elements to guide and align healthcare compliance with compassionate, quality patient care.

Continue readingCritical Challenges in Discharging Patients

The Massachusetts Health and Hospital Association’s Healthcare Legal Compliance Forum General Counsel panel, Dec. 2022, looks at patient discharge challenges.

Continue reading