Does your healthcare organization make proactive decisions about regulatory changes with time to adjust? Three steps to help make decisions farther upstream.

Continue readingTrust in healthcare compliance programs

Four ways to build a healthy culture of compliance. Help your clinical and operational colleagues see compliance as foundational to your healthcare organization

Continue readingEnforcement Issues with Interstate Licensing

Avoid Nurse Licensure Compacts (NLC) compliance risks. Manage the changing healthcare regulations before they become enforcement actions.

Continue readingPhysician Coding and Billing Enforcement: What to Watch For

CJ Wolf, MD writes enforcement action summaries for the YouCompli blog. These summaries provide real-world examples of regulators’ response to practices that don’t fully comply with regulations.

This month’s article looks at physician coding and billing cases. It reflects remarks CJ made at HCCA’s 2022 Compliance Institute. (For more insights from the Compliance Institute, download our white paper on how compliance professionals can help healthcare institutions mitigate risk.)

Physicians are often seen as the drivers in healthcare. They examine patients, order labs and diagnostic testing. They perform procedures and surgeries, admit patients to hospitals, and document in the medical record.

If you ask physicians what they think about coding and billing, most of them will tell you this: The rules do not make sense, are hard to understand, and are constantly changing. Most of them are doing their best to apply the confusing rules as they care for patients. Some might even be billing improperly on purpose. Either way, these examples highlight the consequences of “getting it wrong.” They offer clues for compliance professionals to spot training opportunities before they become enforcement actions.

Billing for services not needed or received

In March of 2022, a New Jersey rheumatologist was convicted by a federal jury for defrauding Medicare and other health insurance programs. She had billed for services that were either unnecessary or were not provided. Court documents demonstrated the physician billed for expensive infusion medication that her practice never purchased. She also fraudulently billed millions of dollars for allergy services that patients never needed or received. The doctor will be sentenced in July for multiple counts of healthcare fraud. Each count carries a maximum penalty of 10 years.

Compliance officers should watch for:

Follow the money. If a practice is billing millions of dollars for allergies services, that code or set of codes is likely to stand out as an outlier to compliance programs monitoring all their billing data. Compliance officers should have a true sense of what their organization’s bread and butter services are. Then, they should perform regular audits of those high dollar, high volume services.

Billing for unnecessary urine drug testing

A Florida physician, serving as a medical director for a sober living facility, was found guilty of healthcare fraud. The federal jury found that he had ordered medically unnecessary urine drug tests. Court documents showed the physician unlawfully billed approximately $110 million of urinalysis (UA) drug testing services that were medically unnecessary for patients. Some of the evidence used at trial included inappropriate standing orders for UA drug tests in exchange for a monthly fee. As a condition of residency, patients had to submit to excessive and medically unnecessary urine drug testing three to four times per week.

Evidence also showed the medical director did not review the UA drug test results and did not use the UA drug tests to treat the patients. This lack of review called the necessity of the tests into question. In addition, the doctor had these same patients sent to his office so he could also fraudulently bill for services through his own practice. He faces up to 20 years in prison for healthcare fraud and wire fraud conspiracy. He faces another 10 years for each of eleven counts of healthcare fraud.

Compliance officers should watch for:

If your organization allows for standing orders, you should have a written policy that guides their use. The policy should outline the risks and benefits of the standing orders. It should describe when they are appropriate and when they are not appropriate. That policy should also outline the process for reviewing standing orders on a regular basis to determine if they are still appropriate. If it’s been more than a year since you’ve reviewed a standing order, you may want to schedule a review soon.

Modifier misuse: unbundling under modifier 25

Billing and coding modifiers can also be an area of risk for physicians. In general, most encounters are reported with one Healthcare Common Procedure Coding System / Current Procedural Terminology (HCPCS/CPT) code. Medicare generally prohibits healthcare providers from separately billing for E&M services provided on the same day as another medical procedure. The exception is if the E&M services are significant, separately identifiable, and above and beyond the usual preoperative and postoperative care associated with the medical procedure.

When the E&M service meets this definition, modifier 25 can appropriately be appended to the E&M code. When that is done, a physician is, in essence, certifying that the procedure and E&M are separate enough to meet the definition of the modifier.

A urology practice learned an expensive lesson by allegedly using modifier 25 inappropriately. The practice agreed to pay $1.85 million to resolve allegations of modifier misuse. The case was initiated by a qui tam whistleblower. Allegedly the practice used modifier 25 to improperly unbundle routine E&M services that were not separately billable from other procedures performed on the same day. As a result, the practice improperly claimed compensation from Medicare for certain urological services. The whistleblower had performed audits that allegedly showed an overall error rate for the practice of 58% with some physicians showing a 100% error rate.

Compliance officers should watch for:

Any specialty could potentially run into problems with modifier 25. Consider common clinical scenarios such as a scheduled procedure. For example, in urology a physician might schedule a patient to return to the office another day for a scope procedure or a prostate biopsy. Frequently, upon return, the procedure is performed but a significant, separately identifiable evaluation and management service might not be performed. In those cases, it would not be appropriate to bill the procedure and an E&M service, but rather only the procedure. Automatically billing an E&M with modifier 25 just because the patient was in the office would be a red flag.

Conclusion

Physicians and their practices need to be aware of coding and billing risks. Enforcement agencies and potential whistleblowers may identify outliers or flat-out fraud. Common mistakes may include a lack of documentation or not performing a service but billing for it anyway. Other common mistakes are billing for procedures or services that were performed but were not medically necessary and misuse of medical codes and/or modifiers.

CJ Wolf, MD, M.Ed is a healthcare compliance professional with over 22 years of experience in healthcare economics, revenue cycle, coding, billing, and healthcare compliance. He has worked for Intermountain Healthcare, the University of Texas MD Anderson Cancer Center, the University of Texas System, an international medical device company and a healthcare compliance software start up. Currently, Dr. Wolf teaches and provides private healthcare compliance and coding consulting services as well as training. He is a graduate of the University of Illinois at Chicago College of Medicine, earned a master’s in education from the University of Texas at Brownsville and was magna cum laude as an undergraduate at Brigham Young University in Provo, UT. In addition to his educational background, Dr. Wolf holds current certifications in medical coding and billing (CPC, COC) and healthcare compliance, ethics, privacy and research (CHC, CCEP, CHPC, CHRC).

Managing regulatory change is a critical way to avoid enforcement actions. YouCompli is the only healthcare compliance solution that combines actionable, regulatory analysis with a simple SaaS workflow to help you manage regulatory change. Read more about the rollout and accountability of requirements or schedule a demo.

Download our white paper on how compliance professionals can help healthcare institutions mitigate risk.

Never miss an article from YouCompli

Telehealth expansion: Interstate licensure compacts benefit patients

Telehealth services and models have expanded rapidly during the pandemic. Healthcare employee burnout, the Great Resignation, and other factors are expected to further accelerate telehealth growth.

Telehealth expansion has led to significant growth in the use of interstate licensure compacts. As more healthcare professionals obtain licensure under compacts, compliance officers need to be aware of interstate licensure requirements – and their effects on patient care.

Increasing use of interstate licensure compacts

The National Council of State Boards of Nursing (NCSBN) recently published its annual report on interstate licensure. It noted 43 states and territories have enacted licensure compacts for nurses, physicians, physical therapists, emergency medical technicians, psychologists, speech therapists/audiologists, occupational therapists, and counselors.

The Nurse Licensure Compact (NLC) is an interstate agreement allowing nurses to practice in multiple states with one multistate license issued from their home state. The compact enables nurses to provide nursing services to patients located in other NLC states via telehealth without obtaining additional licenses. The NCSBN says this approach allows for greater nurse mobility, public protection, and access to care.

In addition, use of the Interstate Medical Licensure Compact (IMLC) grew by 47% in the past two years. The IMLC Commission noted “more than 8,000 licenses were issued through the compact from March 2020 to March 2021.” This is compared with nearly 4,000 licenses issued during the previous 12-month period.

With more healthcare professionals practicing across state lines, patients have more choices. And healthcare compliance officers have processes and procedures to update.

Interstate licensure compacts benefit patients

For patients, one benefit of licensure compacts includes licensing boards being able to ensure that physicians maintain professional integrity and medical standards – regardless of where they practice. As more healthcare professionals obtain licensure under compacts, patients gain greater flexibility in making care decisions.

For example, rural patients can participate in a telehealth visit with a specialist or provider at home. This saves patients the time and expense of driving long distances to see the same provider in a facility setting.

Another positive is the increased use of remote monitoring devices, such as glucose monitors, blood pressure monitors, and heart monitors. Patients can receive state-of-the-art monitoring remotely, instead of as a hospital inpatient. In turn, healthcare costs decrease and patient compliance increases.

A significant patient benefit with expanded telehealth is the inclusion of mental health services. Under the provisions of the Consolidated Appropriations Act of 2021, services for the diagnosis, evaluation, or treatment of mental health disorders may continue as telehealth services. Per the Centers for Medicaid & Medicare Services (CMS), the previous restrictions limiting telehealth mental health services to patients residing in rural areas no longer apply.

Compliance considerations

Compliance officers need to help their organizations keep up as healthcare delivery models change. Organizations will need to update everything from billing codes to human resources policies and procedures to information technology (IT) practices.

For example, compliance officers should partner with Human Resources to make sure out-of-state licensed professionals have been educated in facility policies and procedures. They also need to ensure that professionals working under licensure compacts understand the nuances of the rules and laws in the state they are working.

Compliance officers also need to work with the IT department to ensure that remote devices have been securely connected to the network. They also need to collaborate with the risk department on making sure proper medical professional liability insurance coverage has been obtained for these licensed professionals.

Compliance officers should work with Revenue Cycle on two crucial issues:

- Ensuring that the organization stays abreast of the changes to the CMS list of services payable under the Medicare Physician Fee Schedule when furnished via telehealth.

- Staying current on telehealth visit coverages and coding modifiers to decrease denials of patient charges.

As your team manages your response to continuing regulatory changes, having a system to keep up with the moving parts can help. YouCompli can support your regulatory change management process. It provides regulatory analysis to help you know what changes are coming and decide whether they affect your institution. It also provides requirements, tasks, and deadlines, in clear business English, making it easier for you to manage changes and verify that you’ve taken the proper steps.

Denise Atwood, RN, JD, CPHRM

District Medical Group (DMG), Inc., Chief Risk Officer and Denise Atwood, PLLC

Disclaimer: The opinions expressed in this article or blog are the author’s and do not represent the opinions of DMG.

Denise Atwood, RN, JD, CPHRM has over 30 years of healthcare experience in compliance, risk management, quality, and clinical areas. She is also a published author and educator on risk, compliance, medical-legal and ethics issues. She is currently the Chief Risk Officer and Associate General Counsel at a nonprofit, multispecialty provider group in Phoenix, Arizona and Vice President of the company’s self-insurance captive.

Get more healthcare regulatory change management right to your email!

How is your healthcare organization keeping up with changes in regulations? Read more about our regulatory monitoring process or schedule a demo.

Verify: Show what steps your organization has taken to comply

Health systems look to YouCompli to help them manage the regulatory change management process. They need to be able to make sure the right people were taking the right steps to properly comply with regulations – and they need a system to verify that all those steps were taken. Compliance professionals use it to communicate with regulators, auditors and their Board. They also use the data with colleagues to support operational efficiency and better patient care. (Case study: Compliance function serves as trusted business partner and helps colleagues verify their coding and procedures are up to date.)

YouCompli serves as a single system of record, with analytics and Board reporting to help you verify that your organization is in compliance. That makes it easier for you and your colleagues to focus on patient care with confidence.

In this clip Scott Borsuk explains how YouCompli helps his compliance department verify that proper action has been taken while providing valuable data that can be used to increase department efficiency.

Watch more videos on this topic here and see how YouCompli can help your organization

Demonstrate compliance

Use YouCompli to prove your organization did what it needed to do based on the factors your Board, regulators or auditors care about. Perhaps you need to evaluate the status of all the regulations pertaining to RevCycle, or maybe you need to understand how many regulatory requirements have been completed by each department. YouCompli includes standard and customizable reports to instantly prove that that the right people have taken the right actions on the relevant regulation changes.

Clear, effective reports

- Dynamic reports: Show the health of your compliance program in real-time. Our custom reports summarize critical metrics to share with your Board or regulators.

- Examples include: your compliance posture, the rate of completion of regulatory obligations, and evidence of actions taken in good faith to achieve compliance.

- Proactive collaboration: Use code change and other regulatory change reports to help colleagues get ahead of regulatory and billing changes, minimizing unpaid claims and reducing risk of fines.

Real-time monitoring

- Dashboard: The YouCompli dashboard provides a high-level view of the compliance burden across an organization. Configure the dashboard based on user preferences to see All Regulations, All Requirements, and All Tasks.

- Customized view: Filters and sort tools enable the user to narrow the display based on criteria like Status, Effective Date, and Accountable Party. This same system-wide data can be displayed in a dynamic Calendar View or Task View to drill down into the details of the regulatory response.

- Pinpoint specific issues and actions: Search the entire system to zero in on relevant and urgent data points. You can search by keyword, regulator, functional department, jurisdiction, assigned to, assigned by, and much more.

Measure and influence employee behavior

Attestation: YouCompli includes simple tools to communicate procedure changes and training opportunities to staff, providers, and business associates. Use these tools to measure awareness of relevant regulations and the subsequent changes to procedures and codes of conduct.

A complete regulatory change management solution

YouCompli is the only healthcare compliance solution that addresses all stages of regulatory change management. It helps you know what regulations are changing from agencies you care about. It helps you decide whether those regulations and changes apply to you. It gives you the tools to manage your response to regulatory changes, and it makes it easy for you to verify that your organization put forth best efforts to stay in compliance.

Manage: Involve colleagues to ensure your organization complies with regulatory changes

Managing healthcare regulatory changes is a balancing act. Oftentimes, the Compliance department is responsible for regulatory oversight, project management, and support with individual departments handling the day-to-day management of regulatory requirements. This approach makes it difficult to involve the right people in a regulatory change process and to keep track of the steps they take to comply.

YouCompli helps you manage the whole process of responding to regulatory changes. With our simple tools you can easily plan your response, involve the right people, and track progress. (Read how YouCompli empowered the Compliance department to better manage regulatory change and deliver greater value to the hospital system.)

In this Clip Scott Borsuk explains how YouCompli helps manage regulatory changes by offering tools to assist in preparing and responding to new regulations.

Watch more videos on this topic here and see how YouCompli can help your organization

Jumpstart your response to regulatory changes

Once you’ve decided a regulation applies to your organization, use YouCompli to manage your response. YouCompli provides:

- Clear business requirements and tasks: For every regulation you take on, YouCompli generates a complete set of legally validated business requirements, tasks, and deadlines

- Sample documents: Our analysts write model procedures and tools to simplify your completion of the required task. Download these legally validated expert tools and model procedures and customize them for your own organization.

- Specific roles for your colleagues: build a team for each regulatory change based on your actual needs. You can assign tasks to colleagues based on their functional area, their physical location, their role in the compliance initiative, and the nature of the regulation.

Involve the right people

- Assignments and deadlines: Assign ownership and oversight of tasks to different department heads, functional leaders, or specialists. YouCompli prompts these users to accept, reject, or reassign the task by a stated deadline. All actions are logged in the system and the assigning party receives progress updates.

- Task instructions: if a new regulation will require your organization to submit a form to a regulator and/or modify a procedure, YouCompli lays out the specific tasks to fulfill the requirement. Users simply follow the on-screen prompts to complete the tasks.

- Accountability: If no action is taken by the deadline, YouCompli automatically follows up with the assigned parties. The task cannot be marked as complete until all required actions have been recorded in the system.

Manage and track the entire process

- Real-time updates: YouCompli clearly displays the open, in progress, and completed tasks for the regulation as well as the responsible parties. Simply click into any task to review what’s been done and who still has work to do.

- Email notifications: you can review the task to ensure it has been completed to your satisfaction. Complete audit trail of all the steps taken, including any uploaded files.

- Status reports: Use standard and customizable reports to quickly show your progress toward complying with relevant regulations.

A complete regulatory change management solution

YouCompli is the only healthcare compliance solution that addresses all stages of regulatory change management. It helps you know what regulations are coming out from agencies you care about. It helps you decide whether those regulations and changes apply to you. It gives you the tools to manage your response to regulatory changes, and it makes it easy for you to verify that your organization put forth best efforts to stay in compliance.

Want a real-life example of regulatory change management supported by YouCompli? Read the case study of one West-Coast health system adapting to the public health emergency.

Know: Never miss a relevant regulatory change

YouCompli helps your organization know what regulatory changes are coming. You choose which regulators to monitor and use the business requirements and model documents in YouCompli to know what to do.

Continue readingDecide: YouCompli helps your organization make easy regulatory decisions

Before YouCompli, Compliance Officer Scott Borsuk said he “probably spent six to eight hours a week reading regulations, then copying and pasting them” to share with colleagues. Read the Western Maryland Health System case study.

“It’s not enjoyable reading,” Borsuk noted.

But he had to read closely to be sure he properly analyzed the regulation to see if it applied to him.

Simplify decision-making

“We were not confident that we were catching everything, we had the documents but didn’t know if we missed anything. At the end of the day, we didn’t know if we were making the right changes or not.” – Scott Borsuk, Chief Compliance Officer

Borsuk knew he needed a better system and a stronger approach to managing regulatory change. That’s where YouCompli came in. With YouCompli, Borsuk can easily decide if a regulation applies to his hospital system and how to comply.

YouCompli makes it easy for you to decide which regulatory changes apply to your organization and which tasks need to be performed in order to comply.

In this clip Scott Borsuk explains what regulatory change management is, and how YouCompli assisted his hospital system in achieving desired results.

Watch more videos on this topic here and see how YouCompli can help your organization

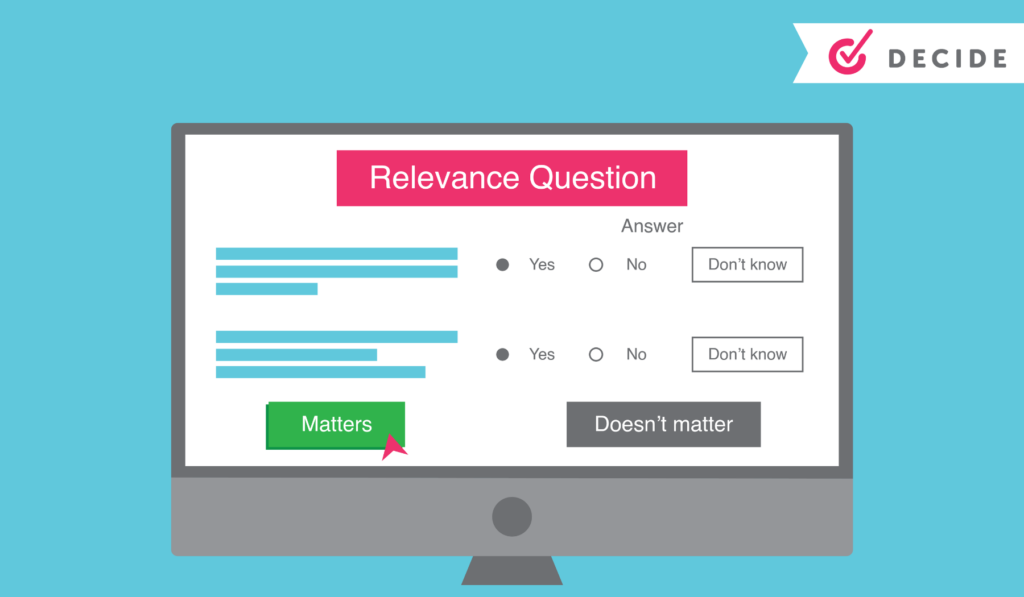

Regulatory analysis to help you decide

- For each requirement associated with a regulation, YouCompli creates a few relevance questions. Users may be asked, for instance, “Is your organization a Medicare provider?” These relevance questions are followed by tips generated by YouCompli to help make your decisions easier.

- We can do this because our analysts read entire regulations, flag relevant changes, and translate technical legal documents into easy-to-understand business requirements.

- If you decide the regulation is not relevant, YouCompli marks it “complete” and removes it from your active tasks.

- All our analysis is checked by Horty Springer, the nation’s leading health care law firm.

Get expertise from colleagues

Sometimes the relevance questions stretch beyond your expertise as a Compliance leader. In those cases, use YouCompli to get the answer from colleague with the right expertise.

- Use the workflow tool to assign a complex relevance question to a subject matter expert

- YouCompli allows you to maintain a directory of subject matter experts who provide compliance leadership within their departments

- The workflow tool also tracks responses and lets your colleague decline or answer the question right in the tool.

A complete audit trail for your relevance decisions

YouCompli tracks all of your relevance decisions over time, so you can see which regulations and changes applied to your organization and why (or why not!)

- All responses to decision criteria, including usernames and date stamps, are recorded in YouCompli to become part of the official record and the compliance audit trail

- The log also captures the reasons for rejecting the requirement or proceeding to the next phase of the workflow.

- YouCompli clients can access the complete audit trail at any time to review previous decisions and the reason for making that decision.

Great decisions help you manage regulatory changes

Once you know about a regulatory change and you’ve used YouCompli’s decision criteria to decide that a regulation applies to you, you’re ready to respond. YouCompli helps you manage the tasks necessary for compliance. And it helps you verify that your organization has put forth best efforts to stay in compliance.

Interested in how a healthcare system used YouCompli to decide which regulatory changes apply? Check out this case study from the Western Maryland Health System.